Hire The Best Financial valuation Tutor

Top Tutors, Top Grades. Without The Stress!

10,000+ Happy Students From Various Universities

Choose MEB. Choose Peace Of Mind!

How Much For Private 1:1 Tutoring & Hw Help?

Private 1:1 Tutors Cost $20 – 35 per hour* on average. HW Help cost depends mostly on the effort**.

Financial valuation Online Tutoring & Homework Help

What is Financial valuation?

Financial valuation refers to determining an asset’s or firm’s economic worth through quantitative techniques. Common methods include DCF (Discounted Cash Flow) and NPV (Net Present Value). DCF projects future cash flows and discounts them back, while NPV measures the value added by an investment. It’s used to price startups, real estate, corporate stocks, and insurance liabilities; banks and investors rely on it every day.

Popular alternative names: - Business valuation - Enterprise valuation - Asset valuation - Corporate valuation - Fair value measurement

Major topics/subjects in financial valuation include time value of money concepts, risk and return trade‑offs, cost of capital, discounted cash flow models, free cash flow analysis, market multiples and comparables, bond and stock valuation, option pricing (e.g., Black‑Scholes), real options analysis, credit risk modeling, merger and acquisition valuation, and Monte Carlo simulation techniques. Real‑life examples include valuing a tech startup before a VC round, estimating the fair price of a corporate bond, or assessing property value for a mortgage.

Its early roots goes back to ancient Mesopotamian clay tablets where traders estimated grain values. In 1938 John Burr Williams formalized the present value idea in “The Theory of Investment Value.” The 1960s saw the rise of CAPM (Capital Asset Pricing Model) by Sharpe and Lintner, linking risk and expected returns. Black‑Scholes arrived in 1973, revolutionizing option valuations. FASB and IASB’s fair value standards in the 1970s‑2000s further standardized practice. More recently, AI‑driven models and ESG (Environmental, Social, Governance) factors have added new dimensions to valuation.

How can MEB help you with Financial valuation?

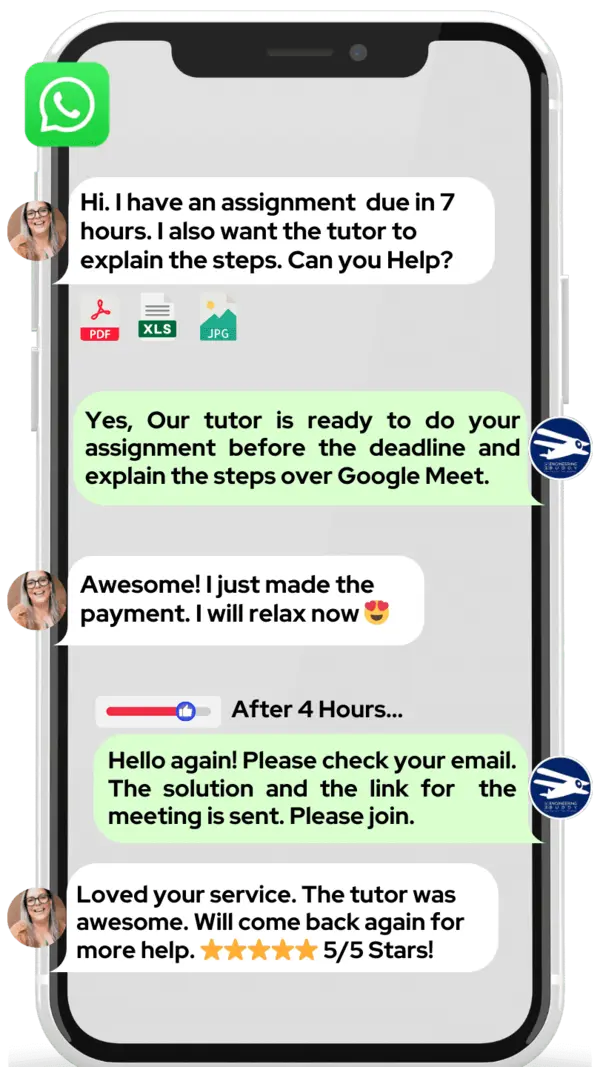

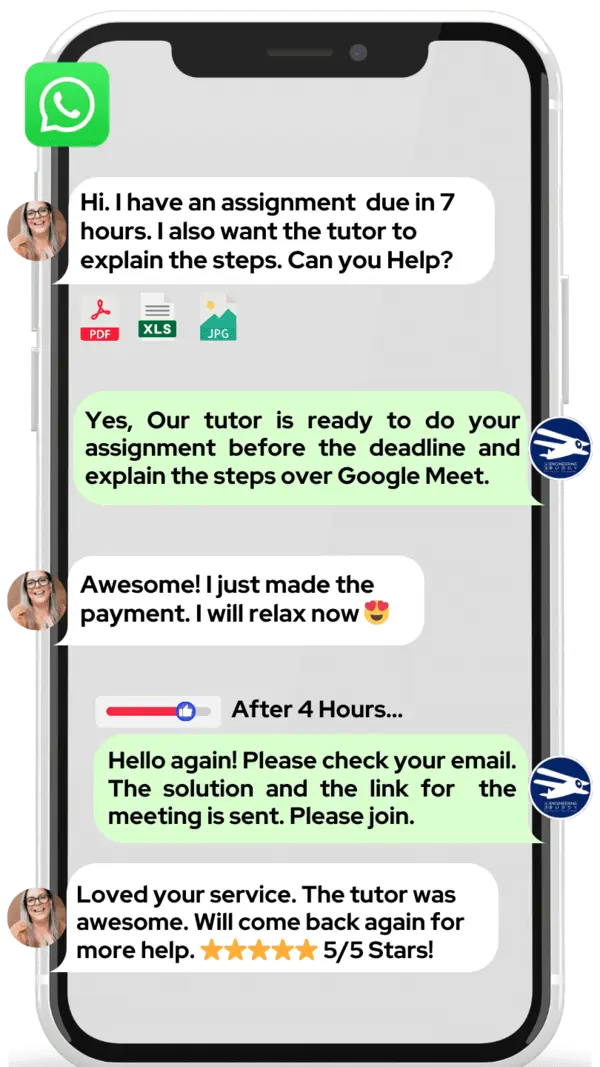

If you want to learn financial valuation, MEB offers private one‑on‑one online tutoring just for you. Whether you are a school, college or university student, our tutors can help you earn top grades on assignments, lab reports, live assessments, projects, essays and dissertations. You can get Financial Valuation Homework Help any time of day or night with our 24/7 instant online service. We prefer WhatsApp chat, but if you don’t use it, please email us at meb@myengineeringbuddy.com.

Most of our students come from the USA, Canada, the UK, the Gulf region, Europe and Australia. They reach out because their subjects feel too hard, they have too many assignments, the questions are tricky, or personal health and learning issues slow them down. Some juggle part‑time jobs, missed classes or the fast pace of their professors.

If you are a parent and your student is struggling, contact us today to help your ward ace exams and homework. They will thank you. MEB also supports more than 1,000 other subjects with expert tutors to make learning easier and school life less stressful.

DISCLAIMER: OUR SERVICES AIM TO PROVIDE PERSONALIZED ACADEMIC GUIDANCE, HELPING STUDENTS UNDERSTAND CONCEPTS AND IMPROVE SKILLS. MATERIALS PROVIDED ARE FOR REFERENCE AND LEARNING PURPOSES ONLY. MISUSING THEM FOR ACADEMIC DISHONESTY OR VIOLATIONS OF INTEGRITY POLICIES IS STRONGLY DISCOURAGED. READ OUR HONOR CODE AND ACADEMIC INTEGRITY POLICY TO CURB DISHONEST BEHAVIOUR.

What is so special about Financial valuation?

Financial valuation stands out by mixing math skills with real-world money decisions. Unlike pure theory or software coding, it tells you what companies, projects, or assets are really worth today. It blends market data, interest rates, and risk models to give clear price estimates. This unique focus makes it vital for investment choices, mergers, and insurance pricing in actuarial science.

One advantage of financial valuation is its real impact: you learn tools that top firms and insurers use daily. It offers clear career paths and demand. But it can be tough, requiring detailed data work, strong statistics, and constant market updates. Compared to theoretical subjects, it feels more practical but less flexible, with answers that may shift as markets change.

What are the career opportunities in Financial valuation?

A common next step after learning financial valuation is to pursue a master’s degree in actuarial science, finance, or a related field. Many students also study for professional credentials like the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM). These programs build on valuation methods and give deeper tools for pricing assets, managing risks, and making data‑driven forecasts.

The career field for financial valuation is growing fast, thanks to tech and data science trends. Valuation experts work in banks, insurance firms, consulting companies, and fintech startups. Remote and hybrid roles are now common. Demand is strong for people who can value companies, real estate, derivatives, and other assets under changing market conditions.

Popular job titles include Valuation Analyst, Risk Analyst, Financial Modeler, and Investment Banking Associate. In these roles, you build valuation models, run scenario tests, prepare reports, and advise on mergers, acquisitions, or capital raising. Work often involves spreadsheets, specialized software, and clear communication with stakeholders.

We study financial valuation to learn how to measure the worth of businesses and assets. Test preparation helps you master core concepts like discounted cash flow and relative valuation. These skills are used in deal making, regulatory filings, loan underwriting, and strategic planning. Strong valuation knowledge gives you an edge in interviews and on the job.

How to learn Financial valuation?

Start by learning basic financial terms like cash flow, discount rate and equity value. Next, study core methods such as discounted cash flow (DCF), comparable company analysis and precedent transactions. Use Excel to build simple valuation models and follow step‑by‑step online tutorials for spreadsheet setup. Practice valuing real or sample companies to see how inputs affect results. Review case studies and common errors, then test yourself by comparing your values to published market numbers.

Financial valuation can seem tough at first because it combines math, accounting and market research. Breaking it into small parts—understanding one method at a time—makes it easier. With regular practice and reviewing real examples, you’ll build confidence and find it much more manageable.

You can learn valuation on your own using books, videos and practice files. However, a tutor can guide you through tricky concepts, answer questions instantly and keep you on track. If you ever feel stuck or need feedback on your models, one‑on‑one support speeds up your progress and helps avoid bad habits.

We offer personalized online tutoring in financial valuation, exam prep and assignment help. Our tutors walk you through each step, check your work and give clear feedback. Sessions are 24/7, so you can study when it suits you. We also provide sample problems, model templates and exam strategies to boost your score—all at affordable rates.

How long it takes depends on your background. If you know basic finance, spending about 5–7 hours a week for 4–6 weeks usually builds a solid valuation foundation. To reach mastery—being able to value any company and tweak models—you may need 2–3 months of regular practice, reviewing case studies and real‑world examples.

Try the following free YouTube channels: Aswath Damodaran’s Valuation videos, Investopedia’s tutorials, Edspira’s finance series. Use websites like Investopedia.com, CorporateFinanceInstitute.com, Coursera.org for structured courses. Read these key books: “Valuation: Measuring and Managing the Value of Companies” (McKinsey), “Investment Valuation” (Aswath Damodaran), and “Financial Modeling” (Simon Benninga). Practice with Excel templates and sample case studies. Join online forums like Wall Street Oasis or Reddit’s r/valuation for peer help and feedback. Many students find these resources a solid starting point.

College students, parents and tutors in the USA, Canada, UK, Gulf and beyond: if you need a helping hand—whether it’s 24/7 one‑on‑one tutoring or assignment support—our MEB tutors are here to help at an affordable fee.