Hire The Best Behavioral Finance Tutor

Top Tutors, Top Grades. Without The Stress!

10,000+ Happy Students From Various Universities

Choose MEB. Choose Peace Of Mind!

How Much For Private 1:1 Tutoring & Hw Help?

Private 1:1 Tutors Cost $20 – 35 per hour* on average. HW Help cost depends mostly on the effort**.

Behavioral Finance Online Tutoring & Homework Help

What is Behavioral Finance?

Behavioral finance examines how psychological influences, cognitive biases and emotions shape investor decisions and markets. It explores why people might overreact to news, herd into assets, or sell winners too early. Real-life: buying Bitcoin during hype or selling stocks after a minor dip. ROI (Return On Investment).

Popular alternative names include behavioral investing, cognitive finance, investor psychology and neuroeconomics.

Major topics include heuristic-driven errors like representativeness and anchoring, overconfidence, loss aversion, mental accounting, and prospect theory. Emotional factors such as regret, fear, and greed influence trading and portfolio decisions in real life—like clinging to losing shares in hopes of a rebound. Market anomalies (momentum, bubbles) challenged EMH. Neurofinance uses neuroscience to study brain responses to risk. Corporate finance sees managerial biases in capital structures. CFA (Chartered Financial Analyst) exams even include questions on these biases. Its importance cant be overstated.

Behavioral finance traces back to the 1970s when psychologists Daniel Kahneman and Amos Tversky published Prospect Theory, challenging the assumption of rational actors. In 1985, Hersh Shefrin and Richard Statman coined the term ‘behavioral finance’ and explored psychological influences on markets. Robert Shiller’s work on market volatility in the 1980s highlighted excess price movements. The 1990s saw the concept of heuristic biases enter mainstream finance curricula. Nobel Prizes awarded in 2002 to Kahneman and Vernon Smith boosted its credibility. Post the 2008 financial crisis, interest surged among academics and practitioners, leading to the rise of financial apps addressing investor emotion.

How can MEB help you with Behavioral Finance?

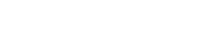

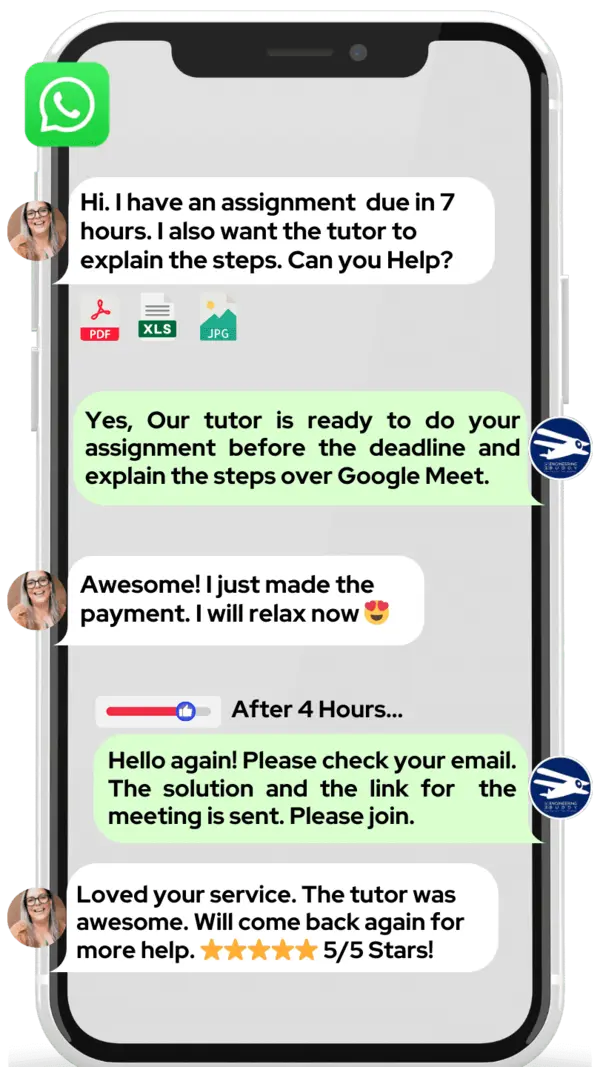

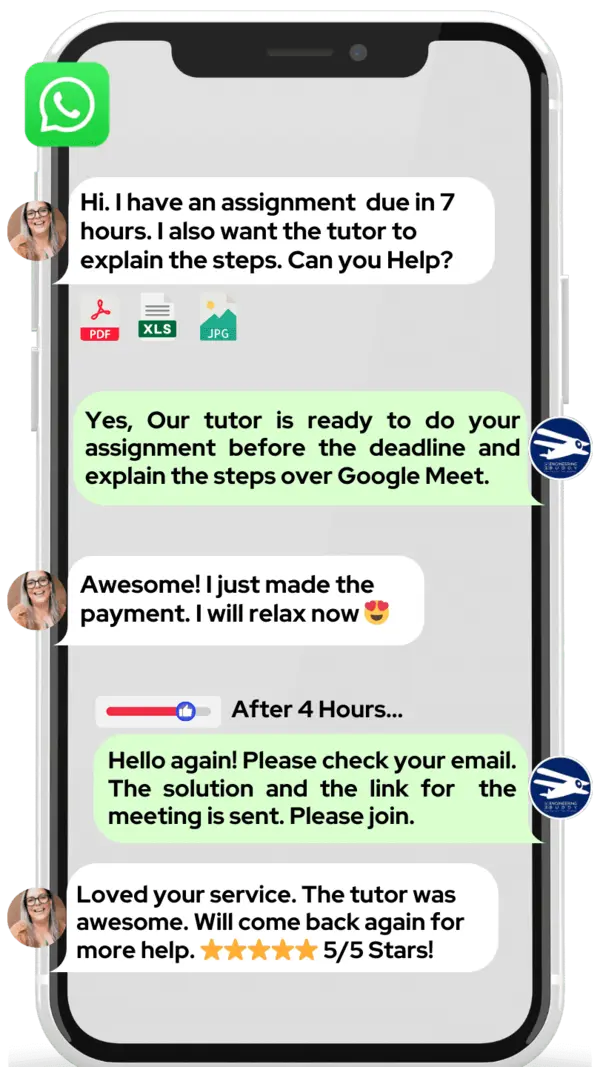

Do you want to learn Behavioral Finance? At MEB, we offer one‑to‑one online Behavioral Finance tutoring. If you are a student in school, college, or university and want top grades on your assignments, lab reports, tests, projects, essays, or dissertations, try our 24/7 instant online Behavioral Finance homework help. We prefer WhatsApp chat, but if you don’t use it, email us at meb@myengineeringbuddy.com.

Most of our students come from the USA, Canada, the UK, the Gulf, Europe, and Australia.

Students ask for our help because their subjects are hard, they have too much homework, they miss classes, or they face health or personal challenges. Some also work part time and find it hard to keep up.

If you are a parent and your ward is struggling, contact us today. We can help your ward get great grades in exams and homework.

MEB also offers tutoring in more than 1000 other subjects with expert tutors. Getting help early makes school easier and less stressful.

DISCLAIMER: OUR SERVICES AIM TO PROVIDE PERSONALIZED ACADEMIC GUIDANCE, HELPING STUDENTS UNDERSTAND CONCEPTS AND IMPROVE SKILLS. MATERIALS PROVIDED ARE FOR REFERENCE AND LEARNING PURPOSES ONLY. MISUSING THEM FOR ACADEMIC DISHONESTY OR VIOLATIONS OF INTEGRITY POLICIES IS STRONGLY DISCOURAGED. READ OUR HONOR CODE AND ACADEMIC INTEGRITY POLICY TO CURB DISHONEST BEHAVIOUR.

What is so special about Behavioral Finance?

Behavioral Finance is unique because it blends psychology with economics, going beyond just charts and statistics. Instead of assuming people always act rationally, it studies real-world choices shaped by emotions, biases, and social influences. This fresh view uncovers why markets rise or fall in unexpected ways that classical theories miss. It also shows why investors might overpay for stocks or fear losses too much.

Compared to traditional economics, Behavioral Finance offers practical tools to understand everyday market puzzles and investor mistakes. Its strength lies in explaining why people stray from perfect logic and in designing better financial choices. However, it can be harder to model and predict, since human behavior is messy and varies over time. Critics say its lessons sometimes lack precise math or clear formulas.

What are the career opportunities in Behavioral Finance?

Many students move on from Behavioral Finance to specialized master’s or doctoral programs in finance, economics, or behavioral science. Universities now offer certificates in decision-making, neuroeconomics, and financial psychology. Online courses on platforms like Coursera and edX also help learners deepen their research skills and prepare for academic roles.

Common job titles include Behavioral Finance Analyst, Risk Manager, Financial Advisor, and User-Experience Specialist at banks, investment firms, or fintech startups. These roles blend data analysis, surveys, and interviews to spot investor biases, design better products, and help firms manage market risk by understanding how people really make financial choices.

We study Behavioral Finance to grasp why investors often act against their own interest, especially during market swings like those seen in recent years. Test preparation for certifications such as the CFA now covers psychology topics, so mastering this field boosts exam success and practical know‑how for real‑world finance.

Behavioral Finance finds everyday use in crafting robo‑advisor algorithms, retirement savings programs, and ESG investment products. By applying its insights, financial firms can nudge clients toward smarter decisions, reduce costly errors, and build tools that match how people actually think about money.

How to learn Behavioral Finance?

Start by getting a good grasp of basic finance and psychology concepts. Read introductory chapters on financial markets, decision biases and risk perception. Watch short videos on key biases like loss aversion and overconfidence. Take notes, make flashcards of important terms and definitions, and work through simple case studies or quiz questions to reinforce what you learn.

Behavioral Finance mixes finance ideas with psychology. It’s often more about understanding concepts than heavy math, so many students find it interesting rather than hard. If you stay curious and practice applying ideas to real-world scenarios, you can master the material step by step.

You can study Behavioral Finance on your own using books, online courses and videos. Self-study works well if you’re disciplined and know where to look for clear explanations. A tutor can speed up your learning by answering questions right away, pointing you to the best resources and tailoring lessons to your style.

At MEB, we offer 24/7 one-on-one online tutoring in Behavioral Finance. Our tutors explain concepts clearly, help you work through practice cases and guide you in writing assignments. You can pick flexible times, and we keep fees affordable so you get expert help without breaking your budget.

Time to learn or prepare depends on your background and goals. For a solid foundation, plan on 6–8 weeks of study at 3–5 hours per week. For exam prep, 4–6 weeks of focused review with practice quizzes and case discussions should get you ready to score well.

Here are some top resources (about 80 words): On YouTube, try playlists from Khan Academy, Investopedia, the CFA Institute channel, and Yale’s Financial Markets lectures. For online courses, explore Coursera’s Behavioral Finance class, edX’s offerings, and MIT OpenCourseWare. Visit websites like Investopedia, BehavioralFinance.net, and the CFA Institute for articles and quizzes. Essential books include Thinking, Fast and Slow by Daniel Kahneman; Misbehaving by Richard Thaler; Behavioral Finance: Psychology, Decision-Making, and Markets by Ackert and Deaves; and the Oxford Handbook of Behavioral Finance.

If you’re a college student, parent or tutor in the USA, Canada, UK, Gulf or elsewhere and need a helping hand—whether online 1:1 tutoring 24/7 or assignment support—our experienced MEB tutors can help at an affordable fee.