Hire The Best Governmental accounting Tutor

Top Tutors, Top Grades. Without The Stress!

10,000+ Happy Students From Various Universities

Choose MEB. Choose Peace Of Mind!

How Much For Private 1:1 Tutoring & Hw Help?

Private 1:1 Tutors Cost $20 – 35 per hour* on average. HW Help cost depends mostly on the effort**.

Governmental accounting Online Tutoring & Homework Help

What is Governmental accounting?

Governmental accounting is specialized accounting for public sector entities like cities, states and school disctricts. It records budgets, expenditures and revenues in funds, ensuring accountability. The Governmental Accounting Standards Board (GASB) sets reporting rules. Examples include municipal bond tracking, federal grant management and utility fund accounting.

- Public sector accounting - Fund accounting - Municipal accounting - Government finance accounting

Fund accounting: tracking separate funds (general, special revenue, capital projects). Budgetary accounting: planning and monitoring of budgets. Revenue & expenditure recognition: determining when to record inflows and outflows. Grants and intergovernmental transactions: managing aid funds. Capital asset & debt accounting: fixed assets, debt issuance and amortization. Financial reporting: Comprehensive Annual Financial Report (CAFR) for public disclosure and audits. Internal controls & compliance frameworks. Performance measurement & transparency: evaluating service outcomes.

Governmental accounting roots trace back to early city treasurer logs in medieval Europe, evolving with 17th‑century British municipal ledgers. In 1842 New York pioneered formal budget statutes. The early 1900s saw U.S. states adopt uniform fund structures. The 1940 creation of the Federal Accounting Standards Advisory Board improved federal reporting. In 1984 the Governmental Accounting Standards Board (GASB) formed to set consistent rules. By 1997 the International Public Sector Accounting Standards (IPSAS) Council began global guidelines. Modern reforms emphasize transparency. Each reform have strengthened comparability and accountability over centuries.

How can MEB help you with Governmental accounting?

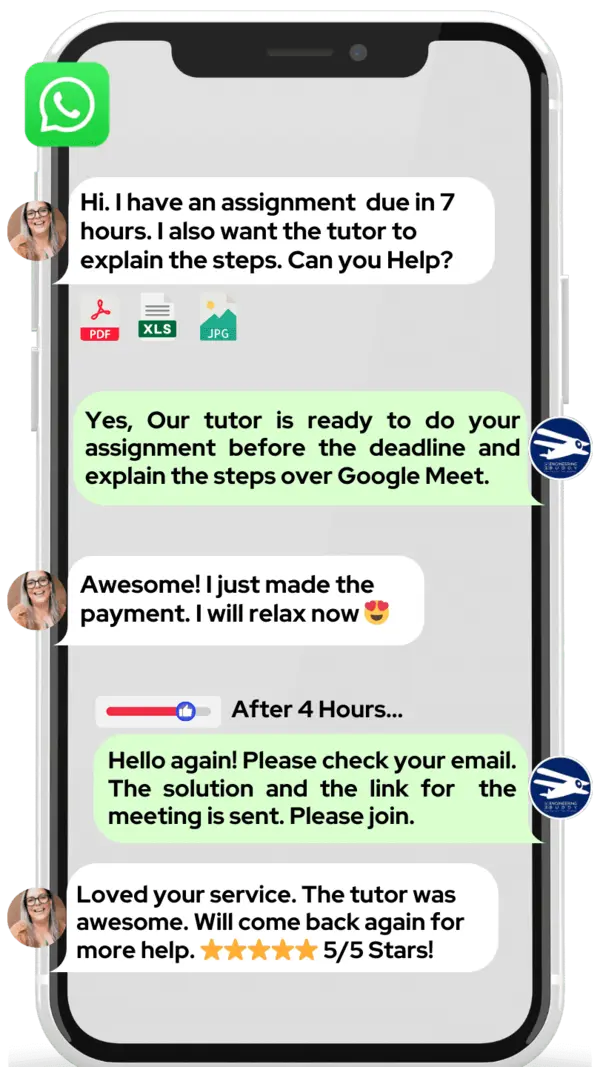

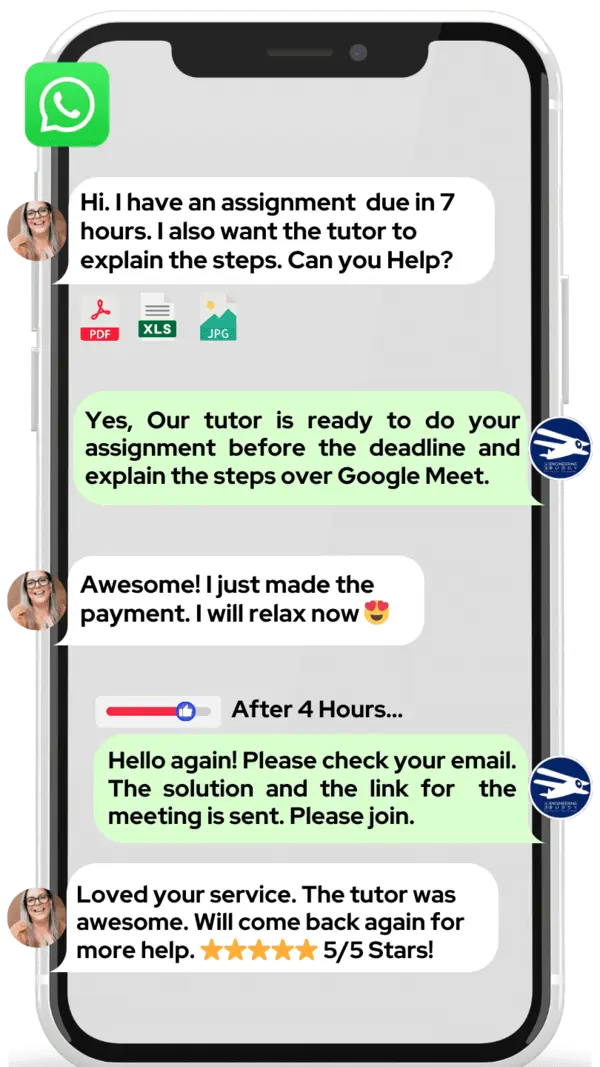

Do you need help with government accounting? At MEB, we offer one-on-one online tutoring in government accounting. If you are a school, college, or university student and want top grades on assignments, lab reports, live tests, projects, essays, or dissertations, you can use our 24/7 instant online homework help. We like to chat on WhatsApp, but if you do not use it, you can email us at meb@myengineeringbuddy.com.

Although we help students everywhere, most of our students come from the USA, Canada, the UK, the Gulf countries, Europe, and Australia.

Students contact our tutors because some courses are hard, there are too many assignments, or some topics take too long to understand. They may also need help because of health issues, personal problems, part-time work, missed classes, or just falling behind in class.

If you are a parent and your ward is finding this subject hard, contact us today so our tutors can help your ward do well in exams and homework. They will thank you!

MEB also offers support in more than 1,000 other subjects. Our tutors and subject experts are ready to help you learn more easily and succeed in school.

DISCLAIMER: OUR SERVICES AIM TO PROVIDE PERSONALIZED ACADEMIC GUIDANCE, HELPING STUDENTS UNDERSTAND CONCEPTS AND IMPROVE SKILLS. MATERIALS PROVIDED ARE FOR REFERENCE AND LEARNING PURPOSES ONLY. MISUSING THEM FOR ACADEMIC DISHONESTY OR VIOLATIONS OF INTEGRITY POLICIES IS STRONGLY DISCOURAGED. READ OUR HONOR CODE AND ACADEMIC INTEGRITY POLICY TO CURB DISHONEST BEHAVIOUR.

What is so special about Governmental accounting?

Governmental accounting is special because it tracks public funds and budgets instead of profits. It uses fund accounting to separate money for different projects, ensuring every cent is used as promised. Compared to business accounting, it focuses on transparency, rules and public interest. Students learn how governments plan spending, report financials and meet legal standards, making it unique among accounting courses.

One advantage of governmental accounting is its clear framework and stable career paths in public service. Students gain skills in budget planning and ethical reporting. On the downside, it can be rigid, with many rules and less focus on profitability. Learning multiple fund types and legal requirements may feel complex. Compared to other accounting subjects, it offers public sector focus but less business flexibility.

What are the career opportunities in Governmental accounting?

Many students who study governmental accounting go on to higher degrees like a Master of Public Administration (MPA), a Master’s in Accounting, or special certificates in government finance. Some also prepare for Certified Public Accountant (CPA) or Certified Government Financial Manager (CGFM) exams. These programs teach advanced budgeting, auditing, and compliance rules.

Popular jobs in this field include government auditor, budget analyst, financial manager, and city or state accountant. Auditors check that public money is spent correctly. Budget analysts plan and track funds. Financial managers prepare reports and ensure laws are followed. Work often involves reviews of spending records, spreadsheets, and policy guidelines.

We study governmental accounting to understand how public funds are managed and reported. Test preparation ensures students know rules set by bodies like the Governmental Accounting Standards Board (GASB). Learning this subject builds skills in math, ethics, and law, all vital for public service roles.

Governmental accounting is used to create budgets for schools, cities, and agencies, prepare transparent yearly reports, audit spending, and guide policy decisions. It helps prevent misuse of taxes, supports clean audits, and keeps citizens informed about how money is used.

How to learn Governmental accounting?

Begin by learning the core concepts of fund accounting: understand what funds are, how budgets work, and the difference between governmental and private‐sector rules. Read one chapter at a time, take notes on key terms like “GASB standards,” and work through sample journal entries. Practice problems daily and review your mistakes. Use flashcards for terminology and create a simple study calendar to cover topics in order.

Governmental accounting uses more rules than general bookkeeping, but it isn’t impossible. You’ll need to get used to new terms and processes, but with steady practice you’ll grasp it. Think of it as learning a second accounting language—challenging at first, but doable if you stick with real examples and hands‐on exercises.

Self‑study is possible if you’re disciplined and know basic accounting. Textbooks, online videos, and practice sets can take you far. A tutor becomes essential when you hit roadblocks or need faster feedback. Working one‑on‑one helps you clear doubts, learn shortcuts, and stay accountable, cutting your study time and boosting your confidence.

MEB offers expert 24/7 online tutoring and assignment support at affordable rates. Our tutors specialize in governmental accounting, provide personalized lesson plans, walk you through homework step by step, and give instant feedback. Whether you need a quick question answered or full exam prep, we tailor sessions to your pace and goals.

On average, beginners should plan 6–8 weeks of study, spending 2–3 hours daily to cover all major topics and practice problems. If you’re already comfortable with basic accounting, you can prepare in 4–6 weeks. Break your study into weekly modules, include review days, and test yourself often to track progress.

Resources include YouTube channels Edspira and Farhat’s Governmental Accounting, websites GASB.org, AccountingCoach.com, KhanAcademy.org, and Cengage.com, plus books like Governmental and Nonprofit Accounting by Bruce, Governmental Accounting by GASB, Fund Accounting by Wheeler, and Schaum’s Outline of Governmental Accounting. Online courses on Coursera and CPA review sites add extra practice.

College students, parents, tutors from USA, Canada, UK, Gulf etc. If you need a helping hand—online 1:1 24/7 tutoring or assignment support—our tutors at MEB can help at an affordable fee.