Hire The Best Mergers & Acquisitions (M&A) Tutor

Top Tutors, Top Grades. Without The Stress!

10,000+ Happy Students From Various Universities

Choose MEB. Choose Peace Of Mind!

How Much For Private 1:1 Tutoring & Hw Help?

Private 1:1 Tutors Cost $20 – 35 per hour* on average. HW Help cost depends mostly on the effort**.

Mergers & Acquisitions (M&A) Online Tutoring & Homework Help

What is Mergers & Acquisitions (M&A)?

1. Mergers and Acquisitions (M&A) describe transactions where two companies combine (merger) or one buys another (acquisition). Finance teams analyze valuation, due diligence, integration plans and legal agreements. For instance, Disney’s acquisition of Pixar shows how combining creative strengths can boost long‑term growth. M&A deals rely on ROI (Return on Investment) metrics to measure success.

2. Corporate combinations • Corporate restructurings • Business consolidations • Takeovers • Buyouts

3. Major topics in M&A include: • Valuation methods (discounted cash flow, comparable company analysis, precedent transactions) • Due diligence processes covering legal, financial and operational risks • Deal structuring (asset vs. share purchases, earn‑outs) • Financing options (debt, equity, mezzanine) • Post‑merger integration focusing on cultural fit, systems integration, change management • Regulatory compliance (antitrust laws, securities regulations) • Negotiation tactics and stakeholder communication

4. From the 1890s railroad consolidation boom through the Roaring Twenties’ utility combinations, M&A has shaped markets. The 1960s saw conglomerate waves as companies like ITT grew across unrelated industries. Antitrust concerns peaked in the 1970s, slowing deals. The 1980s’ LBO (leveraged buyout) era brought junk bonds and hostile takeovers, notably RJR Nabisco. Following the dot‑com crash, tech giants like Google and Facebook pursued strategic acquisitions—YouTube in 2006, Instagram in 2012. Post‑2008 financial crisis, private equity firms became commited buyers, leading to mega‑deals such as Verizon’s 2015 purchase of AOL.

How can MEB help you with Mergers & Acquisitions (M&A)?

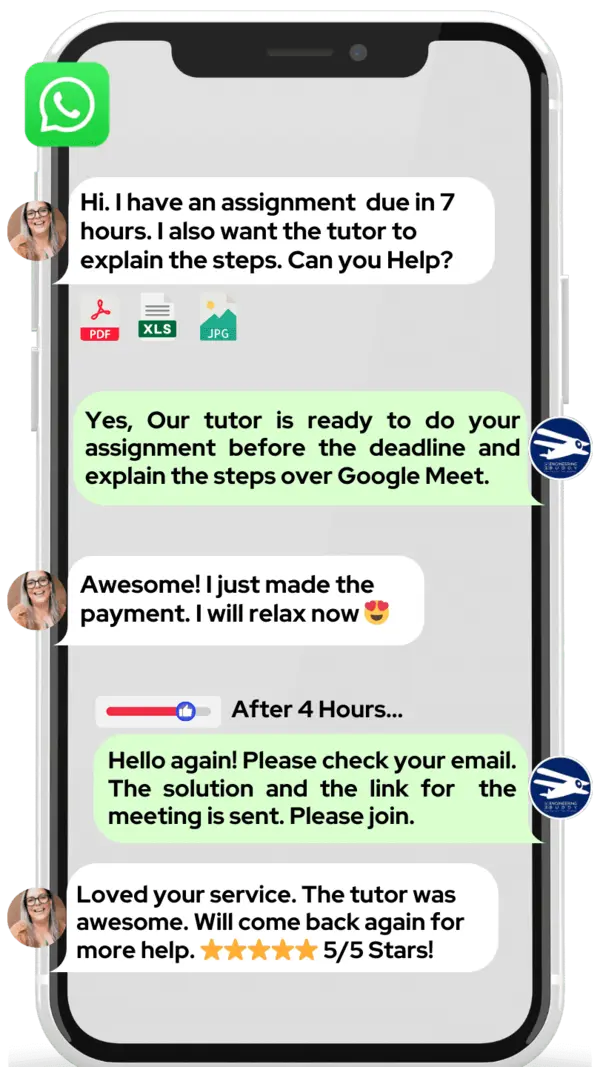

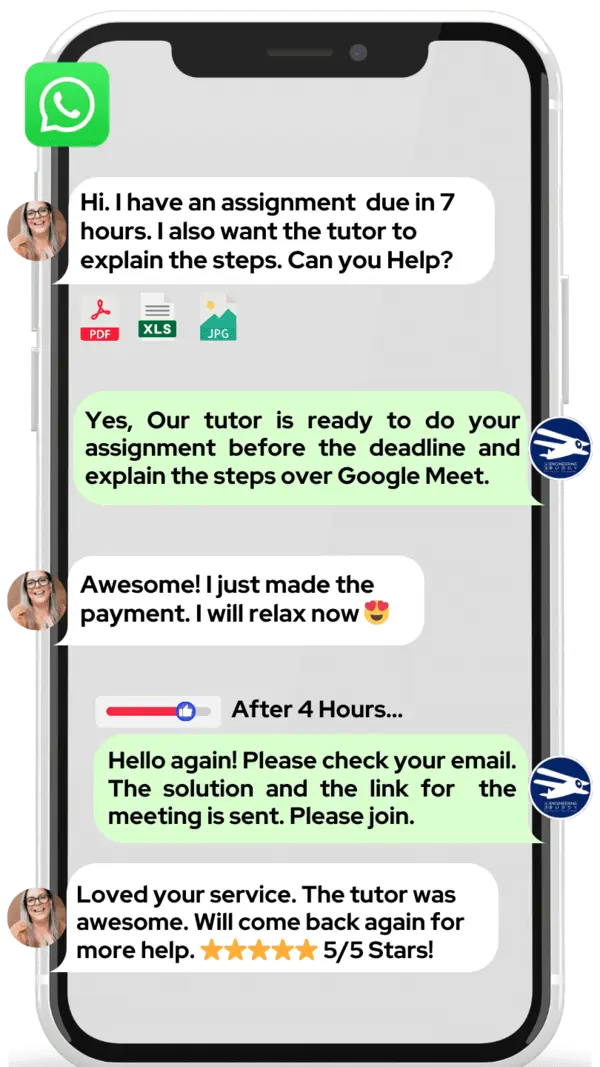

Do you want to learn Mergers & Acquisitions (M&A)? At MEB, our tutors offer one-on-one online M&A tutoring just for you. Whether you are in school, college, or university, we can help you get top grades on assignments, lab reports, live assessments, projects, essays, and dissertations. You can get help anytime—day or night—with our 24/7 instant online M&A homework help. We like to use WhatsApp chat, but if you don’t have it, just email us at meb@myengineeringbuddy.com.

Students from the USA, Canada, the UK, the Gulf, Europe, and Australia often use our service. They reach out because some subjects are really hard, there are too many assignments, or the ideas can be tricky to understand. Other reasons include health or personal issues, part-time jobs, missed classes, or just falling behind in class.

If you’re a parent and your ward is struggling with M&A, contact us today. Our tutors will help them ace their exams and homework, and you’ll see how grateful your ward becomes.

MEB also offers tutoring in over 1,000 other subjects, all taught by expert tutors. Asking for help when you need it makes learning easier and keeps school stress-free.

DISCLAIMER: OUR SERVICES AIM TO PROVIDE PERSONALIZED ACADEMIC GUIDANCE, HELPING STUDENTS UNDERSTAND CONCEPTS AND IMPROVE SKILLS. MATERIALS PROVIDED ARE FOR REFERENCE AND LEARNING PURPOSES ONLY. MISUSING THEM FOR ACADEMIC DISHONESTY OR VIOLATIONS OF INTEGRITY POLICIES IS STRONGLY DISCOURAGED. READ OUR HONOR CODE AND ACADEMIC INTEGRITY POLICY TO CURB DISHONEST BEHAVIOUR.

What is so special about Mergers & Acquisitions (M&A)?

Mergers & Acquisitions is special because it studies how companies join, buy, or merge with each other. Unlike standard accounts topics that focus on book entries or budgets, M&A deals with real‑life value, strategy and law. It brings a mix of finance, negotiation and market analysis. This makes it more dynamic and strategic than many other accounting subjects.

One advantage of M&A is its link to real business events, making lessons feel alive and practical. It also opens doors to high‑paying careers in investment, consulting or corporate roles. On the downside, it involves heavy reading, complex valuation models and legal rules that can be tough on beginners. Its unpredictable outcomes and fast pace add to the learning curve.

What are the career opportunities in Mergers & Acquisitions (M&A)?

Many students move on from an introductory M&A course into advanced degrees like an MBA with a finance focus, master’s programs in corporate finance, or specialized certifications such as Chartered Financial Analyst (CFA) and online diplomas in deal structuring. Recent trends also show growing interest in cross‑border transactions, digital business combinations, and ESG‑driven mergers.

Career scope in M&A is strong, especially in investment banks, private equity firms, and corporate development teams at large companies. Graduates often join mid‑sized advisory boutiques or global banks, where they help design deals and assess takeover targets. Demand stays high as firms seek growth through acquisitions.

Popular job roles include M&A analyst, due diligence associate, valuation specialist, and integration manager. Analysts build financial models and forecasts. Due diligence teams dig into legal, financial, and operational records. Integration managers plan how two companies combine systems and cultures after a deal closes.

We study M&A to learn how companies grow, create value, and manage risk during big transactions. Its applications range from strategic expansion and turnarounds to corporate spin‑offs. Knowing M&A tools and methods gives students an edge in finance careers and real‑world dealmaking.

How to learn Mergers & Acquisitions (M&A)?

Start by getting a clear picture of what M&A means. Begin with basic corporate finance concepts—read short articles or watch overview videos on why companies merge, deal structures, valuation methods, and due diligence. Next, dive into one topic at a time: learn how to build a simple financial model, study legal frameworks, then practice on real or sample case studies. Take notes, quiz yourself with flashcards on key terms, and review your mistakes. Steady practice every week builds strong skills.

M&A can seem tough at first because it combines finance, law, and strategy. But it’s no more difficult than other finance subjects if you break it into small pieces. Focus on one concept at a time—valuation, deal process or accounting adjustments—and move on only when you’re comfortable. Consistent practice, real-world examples and routine self-testing make it much easier to master.

You can start learning M&A on your own using free and paid resources, structured courses, and YouTube videos. A tutor isn’t strictly required if you’re disciplined, but a guide can speed up your progress, answer questions immediately, and give feedback on your models and write‑ups. If you run into tricky problems or need personalized tips, having a tutor or mentor is a big advantage.

Our tutors at MEB offer one‑to‑one online sessions, assignment support and real‑time feedback tailored to your level. We share curated case studies, sample models, legal checklists and exam‑style questions. You choose the pace and topics you need, from basic concepts to advanced deal structuring. Every session is designed to clear doubts and build confidence so you can tackle M&A assignments or exams with ease.

Most students need around three to six months of part‑time study (about five hours weekly) to grasp M&A fundamentals, do simple modeling and handle case exercises. If you study full‑time or focus on key topics, you can shorten this to 8–10 weeks. Track your progress, set mini‑goals, and adjust your pace based on practice results to stay on target.

Here are some top resources: YouTube channels like Mergers & Inquisitions/Breaking into Wall Street, Corporate Finance Institute, EduPristine; websites such as Investopedia, Coursera, edX, Khan Academy; books including Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions by Rosenbaum & Pearl; Mergers & Acquisitions Basics by Donald DePamphilis; Valuation: Measuring & Managing the Value of Companies by McKinsey & Company; and free case studies on Harvard Business School’s website.

College students, parents, tutors from USA, Canada, UK, Gulf etc.—if you need a helping hand, be it online 1:1 24/7 tutoring or assignments, our tutors at MEB can help at an affordable fee.