Hire The Best Tax law Tutor

Top Tutors, Top Grades. Without The Stress!

10,000+ Happy Students From Various Universities

Choose MEB. Choose Peace Of Mind!

How Much For Private 1:1 Tutoring & Hw Help?

Private 1:1 Tutors Cost $20 – 35 per hour* on average. HW Help cost depends mostly on the effort**.

Tax law Online Tutoring & Homework Help

What is Tax law?

Tax law is the body of statutes, regulations, and case precedents governing the imposition, collection, and enforcement of taxes by governmental authorities. It dictates how individuals and businesses calculate, report, and pay income, sales, property, and payroll taxes. For example, the IRS (Internal Revenue Service) enforces U.S. federal tax codes.

Alternative names include taxation law, fiscal law, revenue law, tax code, tax legislation, and tax regulations.

Major topics include income tax, which covers earnings from wages and investments; corporate tax, which applies to business profits; VAT (Value Added Tax), a consumption tax added at each stage of production; payroll taxes withheld by employers; property taxes based on real estate values; estate and gift taxes on transfers of wealth; transfer pricing rules for multinationals dealing with cross-border transactions; tax treaties to prevent double taxation; and tax planning and compliance strategies. For example, online retailers adjust prices to account for different VAT rates across EU countries.

Tax law has evolved over millennia. Ancient Egypt imposed grain levies on farmers around 3000 BC. The Roman Empire implemented income and property taxes by the first century AD. U.S. tax history began with the Revenue Act of 1862, funding Civil War efforts. In 1913, the Sixteenth Amendment introduced the federal income tax and the Internal Revenue Service (IRS) was established after. Payroll taxes for Social Security began in 1935. The landmark Tax Reform Act of 1986 simplified brackets and closed loopholes. Recently, digital services and global minimum tax rules reflect our interconnected economy. Complex. Its often revised by lawmakers.

How can MEB help you with Tax law?

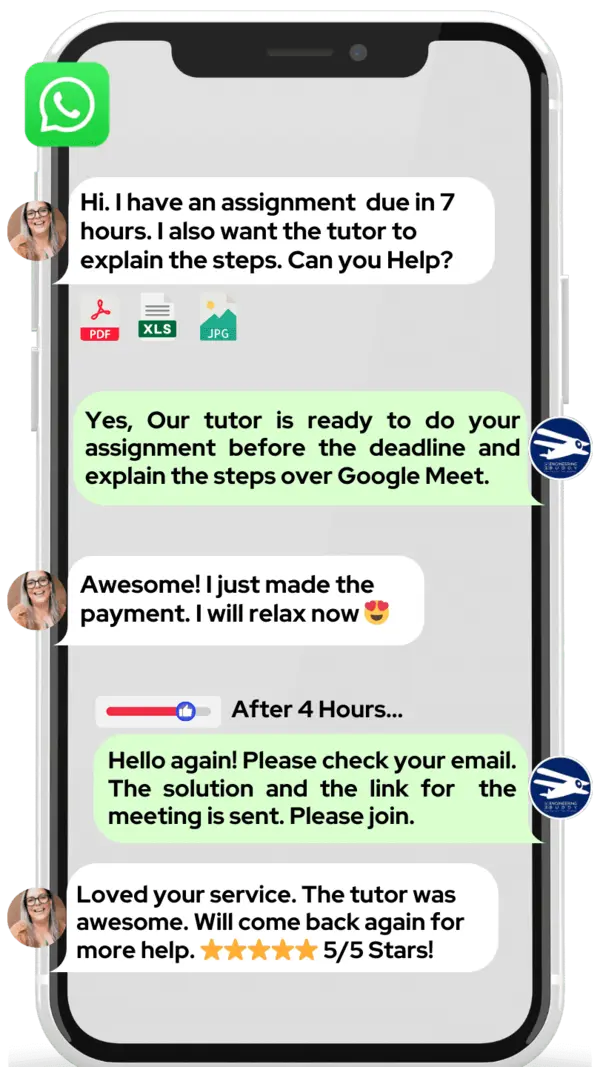

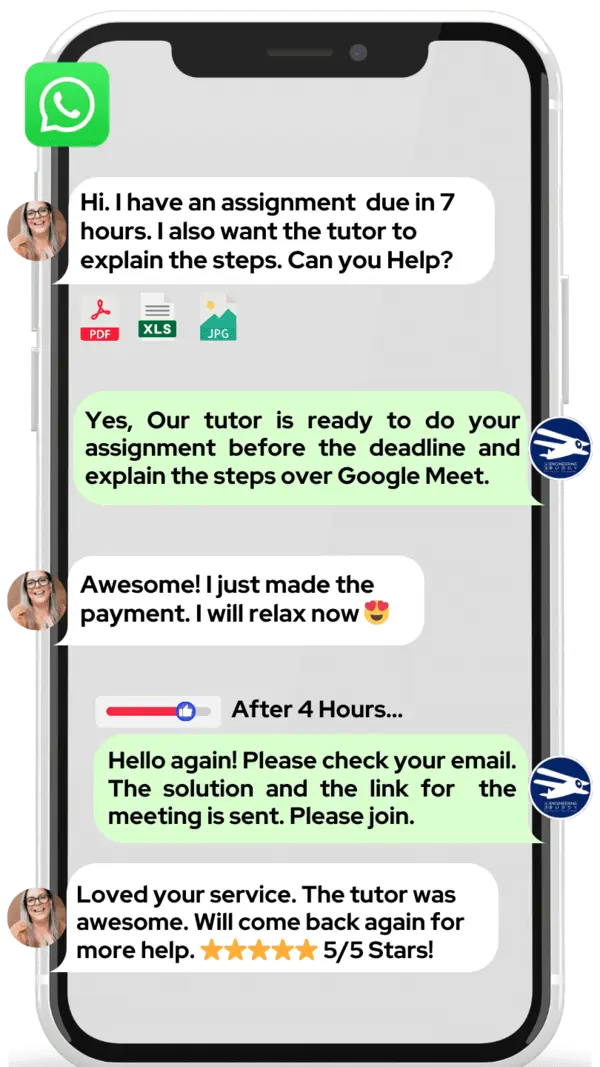

Need help learning tax law? MEB offers one‐on‐one online tax law tutoring just for you. If you are a student in school, college or university and want top grades on assignments, lab reports, quizzes, projects, essays or dissertations, try our 24/7 instant online tax law homework help. We prefer WhatsApp chat. If you don’t use WhatsApp, email us at meb@myengineeringbuddy.com

Our students come from places like the USA, Canada, the UK, the Gulf, Europe and Australia.

Students ask us for help when subjects feel too hard, assignments pile up, questions are tricky or concepts are confusing. Sometimes they face health or personal challenges, learning difficulties, part‑time work or missed classes.

If you are a parent and your ward is struggling with tax law, contact us today. Our tutors can help your ward succeed in exams and homework.

MEB also offers support in over 1000 other subjects. Our tutors and experts make learning easier and help students achieve academic success. It’s important to ask for help when you need it so you can enjoy a stress‑free study life.

DISCLAIMER: OUR SERVICES AIM TO PROVIDE PERSONALIZED ACADEMIC GUIDANCE, HELPING STUDENTS UNDERSTAND CONCEPTS AND IMPROVE SKILLS. MATERIALS PROVIDED ARE FOR REFERENCE AND LEARNING PURPOSES ONLY. MISUSING THEM FOR ACADEMIC DISHONESTY OR VIOLATIONS OF INTEGRITY POLICIES IS STRONGLY DISCOURAGED. READ OUR HONOR CODE AND ACADEMIC INTEGRITY POLICY TO CURB DISHONEST BEHAVIOUR.

What is so special about Tax law?

Tax law stands out because it combines rules and numbers to shape how governments collect money. Unlike other account subjects, it ties directly to public policy and daily life. Its laws change often, so students learn to adapt and stay updated. This subject blends legal language with calculations, making it both exact and linked to real-world decisions.

As part of account studies, tax law offers clear benefits and some drawbacks. On the plus side, it leads to stable careers, sharpens analytical skills and opens doors in finance, law or consulting. However, its complexity and frequent rule changes demand constant reading and attention to detail. Compared to other courses, it can feel dense, yet it builds practical expertise.

What are the career opportunities in Tax law?

Many students move on to specialized master’s degrees or professional diplomas in taxation or financial law after a basic tax law course. Popular paths include an LLM in Taxation, a Master’s in Tax Policy, or certified programs like the Chartered Tax Adviser or Enrolled Agent courses. These build deep knowledge of tax codes and planning strategies.

Tax law graduates often work as tax consultants, in-house tax lawyers, audit specialists, or policy analysts. As a tax consultant, you guide businesses through filings and compliance. In-house lawyers tackle contract reviews and dispute resolutions. Audit specialists check records for accuracy, and policy analysts research new tax rules for government or think tanks.

We study tax law and prepare for its exams to understand rules that affect individuals and companies. Test prep helps students learn how to interpret statutes, apply regulations to real cases, and meet strict filing deadlines. This training builds strong analytical and problem‑solving skills.

Knowing tax law is useful in many areas: business planning, financial advising, and public policy. It ensures legal compliance, helps clients save money, and supports fair tax systems. Strong tax expertise opens doors to leadership roles in finance and government.

How to learn Tax law?

Start by getting a clear syllabus or course outline. Break it into topics like income tax, deductions, credits and filing rules. Get a good textbook or online course and read one topic at a time. Summarize key terms in your own words, work through example problems, then try past exam questions. Review mistakes and make flashcards for hard terms. Stick to a weekly study schedule and join a study group or forum to discuss tricky points.

Tax law can seem tough at first because of its technical terms and changing rules. With steady practice, clear explanations and real‑world examples, it gets easier. Focus on understanding the logic behind rules, not just memorizing. Regular problem practice and revision make it much more manageable over time.

You can definitely start on your own using textbooks, videos and government websites. If you hit confusing spots or fall behind, a tutor can save you time by pointing out shortcuts and clarifying tricky concepts. A good tutor also keeps you motivated and makes sure you stay on track.

MEB offers one‑on‑one online tutoring 24/7 with expert tax law tutors. We provide personalized study plans, live problem‑solving sessions and detailed feedback on assignments. Whether you need help understanding rules, practicing cases or preparing for exams, our tutors guide you step by step, all at affordable rates.

Most students take about 2–3 months of regular study—around 1–2 hours a day—to cover core topics and practice past papers. If you already know basic accounting, you might finish in 6–8 weeks. Plan extra time for review and mock tests so you feel confident on exam day.

Here are some top resources: YouTube channels like “The Tax Tutor,” “Edspira,” and “Learn Accounting Fast” offer clear video lessons. Educational sites such as IRS.gov, Khan Academy’s tax section (khanacademy.org), and TaxFoundation.org provide articles and quizzes. Popular textbooks include “Federal Income Taxation Fundamentals” by James Smith, “Principles of Taxation for Business and Investment Planning” by Sally Jones, and “Taxation Made Simple” by Tim Robinson. These cover key concepts and practice problems widely used by students.

If you’re a college student, parent or tutor in the USA, Canada, the UK or Gulf countries and need a helping hand—be it 24/7 online one‑on‑one tutoring or assignment support—our expert MEB tutors can guide you in Tax law and related subjects at affordable rates.