Hire The Best Fixed Income Tutor

Top Tutors, Top Grades. Without The Stress!

10,000+ Happy Students From Various Universities

Choose MEB. Choose Peace Of Mind!

How Much For Private 1:1 Tutoring & Hw Help?

Private 1:1 Tutors Cost $20 – 35 per hour* on average. HW Help cost depends mostly on the effort**.

Fixed Income Online Tutoring & Homework Help

What is Fixed Income?

Fixed Income (FI) refers to investment in debt securities that pay regular interest and return principal at maturity. Examples include government bonds, municipal bonds, corporate bonds, and certificates of deposit. Investors rely on predictable cash flows, making FI a cornerstone for portfolios seeking stability and income amid market volatility.

Popular alternative names often found in textbooks and media: • Debt securitites (debt instruments) • Bond market • Credit market • Fixed‑interest securities

Key subjects cover valuation, risk analysis, and market structures. Duration and convexity measure price sensitivity to interest rate changes. Yield curve theory examines relationships between short‑ and long‑term yields. Credit risk assessment involves default probabilities and recovery rates. Securitization explores pooling of assets like mortgage‑backed securities (MBS) and asset‑backed securities. Interest rate derivatives—swaps, futures and options—allow hedging of exposures. Secondary market trading and liquidity are also critical. For instance, traders hedge corporate bond exposures with swaps tied to LIBOR.

The origins trace back to regularizing US Treasury debt in the late 18th century. In 1909 Moody’s introduced the first bond credit ratings, revolutionizing risk assessment. The 1970s saw runaway inflation pushing yields sky high. Derivatives took off in the early 1980s with interest rate swaps. Securitization boomed in the 1990s, spawning mortgage‑backed securities (MBS) that reshaped housing finance. The 2008 crisis exposed flaws in these structures, leading to tighter regulations under Dodd‑Frank. Recently, negative‑yield government bonds and central bank interventions during the 2020 pandemic have further transformed the fixed income landscape, highlighting its ever-evolving nature.

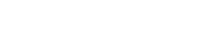

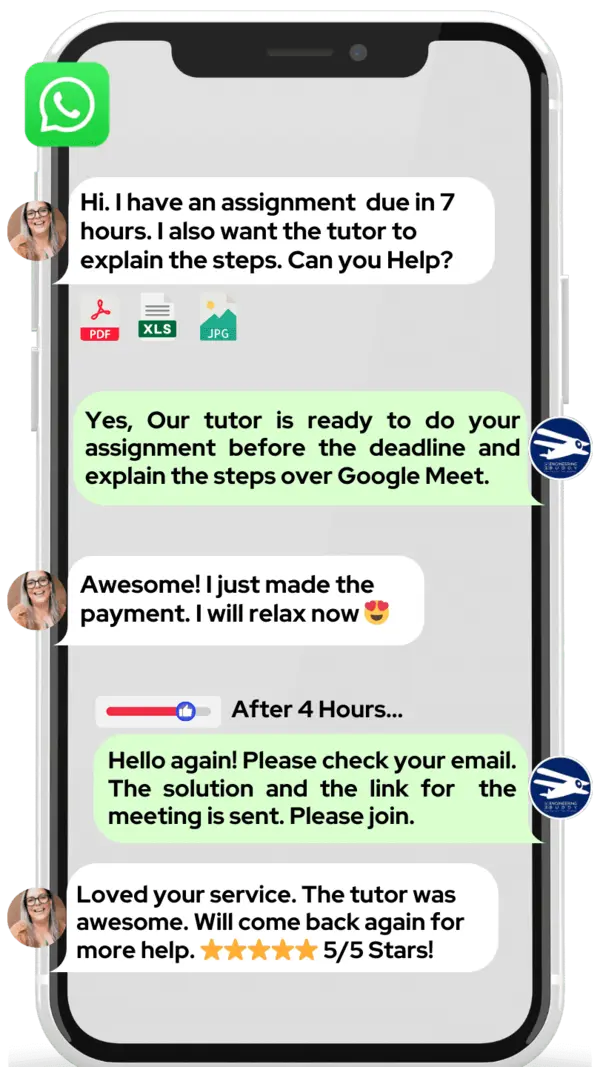

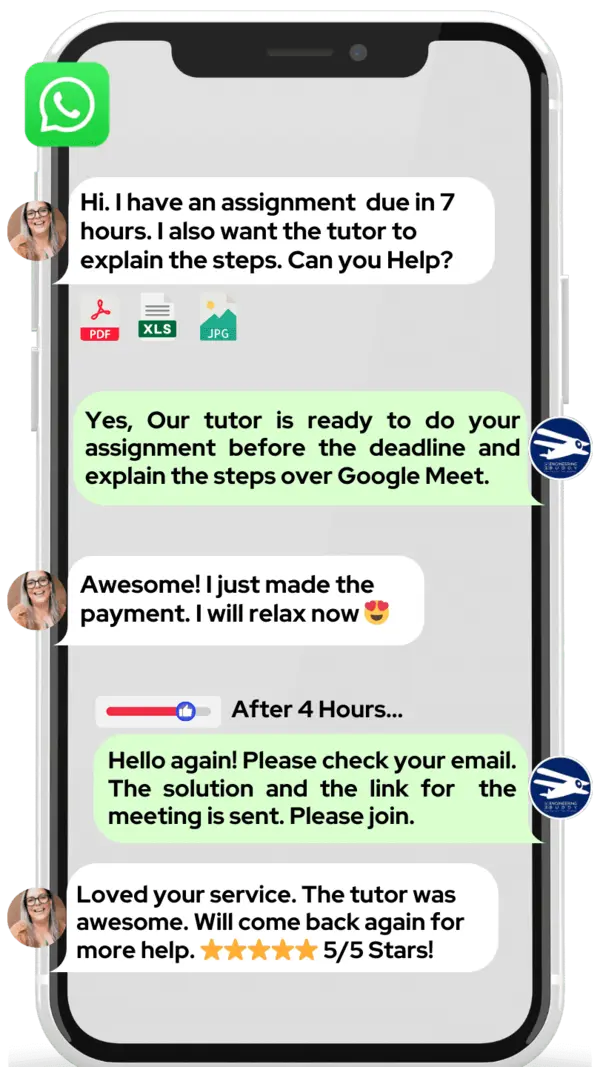

How can MEB help you with Fixed Income?

Do you want to learn Fixed Income? MEB gives you personal, one‑on‑one online Fixed Income tutoring. If you are a school, college, or university student and want top grades on your assignments, lab reports, tests, projects, essays, or dissertations, you can get 24/7 instant Fixed Income homework help with us. We prefer WhatsApp chat. If you don’t use WhatsApp, send an email to meb@myengineeringbuddy.com.

Our students come from the USA, Canada, the UK, Gulf countries, Europe, and Australia, but we help students from anywhere.

Students ask us for help because some courses are hard, they have too many assignments, or the questions and ideas are tricky and take a long time to learn. Some students have health or personal issues, work part time, miss classes, or find it hard to keep up with their tutor.

If you are a parent and your ward is having trouble in this subject, get in touch today. Our tutors will help your ward do great in exams and homework. They will be grateful!

MEB also covers more than 1,000 other subjects with top tutors. It is smart to ask a tutor for help when you need it. This makes learning easier and school less stressful.

DISCLAIMER: OUR SERVICES AIM TO PROVIDE PERSONALIZED ACADEMIC GUIDANCE, HELPING STUDENTS UNDERSTAND CONCEPTS AND IMPROVE SKILLS. MATERIALS PROVIDED ARE FOR REFERENCE AND LEARNING PURPOSES ONLY. MISUSING THEM FOR ACADEMIC DISHONESTY OR VIOLATIONS OF INTEGRITY POLICIES IS STRONGLY DISCOURAGED. READ OUR HONOR CODE AND ACADEMIC INTEGRITY POLICY TO CURB DISHONEST BEHAVIOUR.

What is so special about Fixed Income?

Fixed Income stands out in finance because it focuses on debt and bond markets. It covers lending money to governments or companies in exchange for regular interest payments. Students learn about yield curves, credit ratings, and interest rate risks. This subject combines math with real‑world examples, teaching how to value bonds and manage cash flows over time. Its clear rules make it practical.

Compared to other finance subjects, Fixed Income offers stable examples and a clear learning path. Its main advantage is lower volatility and predictable cash flows, helping beginners avoid market swings. On the downside, returns tend to be smaller, and interest rate shifts can still cause losses. Its detailed rules may feel rigid, making it seem less exciting than equity or derivative topics.

What are the career opportunities in Fixed Income?

Many students who dive into fixed income move on to master’s degrees in finance or financial engineering. They also earn well‑known certificates like the CFA or FRM. Online programs and short courses in bond markets and credit analysis are growing. Recent trends include micro‑credentials in green bonds and sustainable debt.

On the career side, popular job roles include fixed‑income analyst, bond trader, portfolio manager, and risk manager. Analysts research credit quality and yields, traders buy and sell bonds, portfolio managers build income‑focused portfolios, and risk managers keep an eye on interest‑rate risks and regulations.

We study fixed income to understand how debt markets work. It helps in test prep for exams like CFA Level I and II. Learning these tools shows how interest rates, inflation, and credit ratings affect investments. This knowledge also boosts analytical and math skills.

Fixed‑income know‑how applies to government and corporate borrowing, pension fund planning, and financial regulation. It helps investors build stable income streams and manage risk. Companies and policymakers use it to set borrowing costs and plan budgets.

How to learn Fixed Income?

Start by building a strong base: learn what bonds are, how interest rates work, and how to calculate yields. Step 1: read a clear introduction to fixed income (like Investopedia’s bond guide). Step 2: watch short videos on bond pricing and duration. Step 3: practice simple exercises on coupon, yield to maturity, and price. Step 4: move to advanced topics like credit risk and yield curves. Review your notes and solve practice problems until you feel confident.

Fixed income can seem math‑heavy, but it isn’t out of reach. You’ll use formulas for present value, yield, and duration, but these follow simple rules once you see a few examples. The main challenge is keeping track of multiple steps. With regular practice and clear examples, most students find they can master fixed income concepts and calculations.

You can absolutely study fixed income on your own if you’re disciplined and follow a structured plan. Self‑study works best with good resources and a steady schedule. However, a tutor can speed up your learning, answer doubts instantly, and keep you on track—especially when you hit tough spots like credit spreads or immunization strategies.

Our tutors at MEB offer one‑on‑one guidance tailored to your needs. We’re available 24/7 for online sessions, homework help, mock questions, and exam prep. You’ll get step‑by‑step explanations, practice worksheets, and real‑time feedback. Our goal is to make fixed income clear, build your confidence, and help you score high—all at an affordable fee.

Most students need about 2–3 months of steady study—1–2 hours per day—to grasp core fixed income topics and be ready for exams. If you’re short on time or starting from zero, add focused review sessions and practice tests. Adjust your pace based on your background: finance majors might need less time, while newcomers may need a bit more.

Khan Academy’s finance channel offers short clips on bond valuation, YouTube channel Bionic Turtle focuses on FRM fixed income. Investopedia’s bond guide, Coursera’s Fixed Income course by Rice University, edX’s Columbia University Fixed Income Principles. Books include Fixed Income Securities by Bruce Tuckman, Bond Markets, Analysis and Strategies by Frank Fabozzi, CFA Institute’s Fixed Income readings. Try Wiley’s practice problems and AnalystPrep’s tests. Financial Times and Bloomberg teach through articles and videos. Most are free or low cost.

College students, parents, tutors from USA, Canada, UK, Gulf etc are our audience; if you need a helping hand—online 1:1 24/7 tutoring or assignment help—our tutors at MEB can help at an affordable fee.