Hire The Best Personal Finance Tutor

Top Tutors, Top Grades. Without The Stress!

10,000+ Happy Students From Various Universities

Choose MEB. Choose Peace Of Mind!

How Much For Private 1:1 Tutoring & Hw Help?

Private 1:1 Tutors Cost $20 – 35 per hour* on average. HW Help cost depends mostly on the effort**.

Personal Finance Online Tutoring & Homework Help

What is Personal Finance?

Personal Finance encompasses how individuals manage money, including income, expenses, savings, investments, and debt. It involve setting goals, budgeting, insurance choices, tax planning, retirement planning (eg: opening an IRA, Individual Retirement Account), and estate considerations. It also helps prevent overspending and build wealth over time.

Popular alternative names include personal money management, household finance, or personal financial management (PFM, Personal Financial Management).

Key topics cover budgeting—tracking rent, groceries or subscription costs; cash‑flow management; debt management for student loans, credit cards and mortgages; building an emergency fund (often three to six months’ expenses); insurance planning for health, life and property; fundamentals of investing in stocks, bonds and mutual funds; retirement planning with 401(k)s and IRAs; tax planning to limit liabilities; and estate planning to transfer assets smoothly. Education funding and real estate investment strategies also play major roles in many people’s plans.

Early 19th century saw the rise of savings banks in Europe, giving workers new ways to deposit small amounts safely. The Great Depression of the 1930s triggered stricter regulations and the creation of the Federal Deposit Insurance Corporation (FDIC) in 1933, protecting individual deposits. Post‑World War II economic growth brought widespread consumer credit use. In 1978 the introduction of the 401(k) retirement plan in the US revolutionized long‑term saving. The 1990s brought online banking, letting customers check balances at home. The 2008 financial crisis underscored the importance of emergency savings and debt management. Today, mobile wallets and robo‑advisors reshape daily money habits worldwide.

How can MEB help you with Personal Finance?

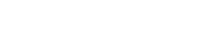

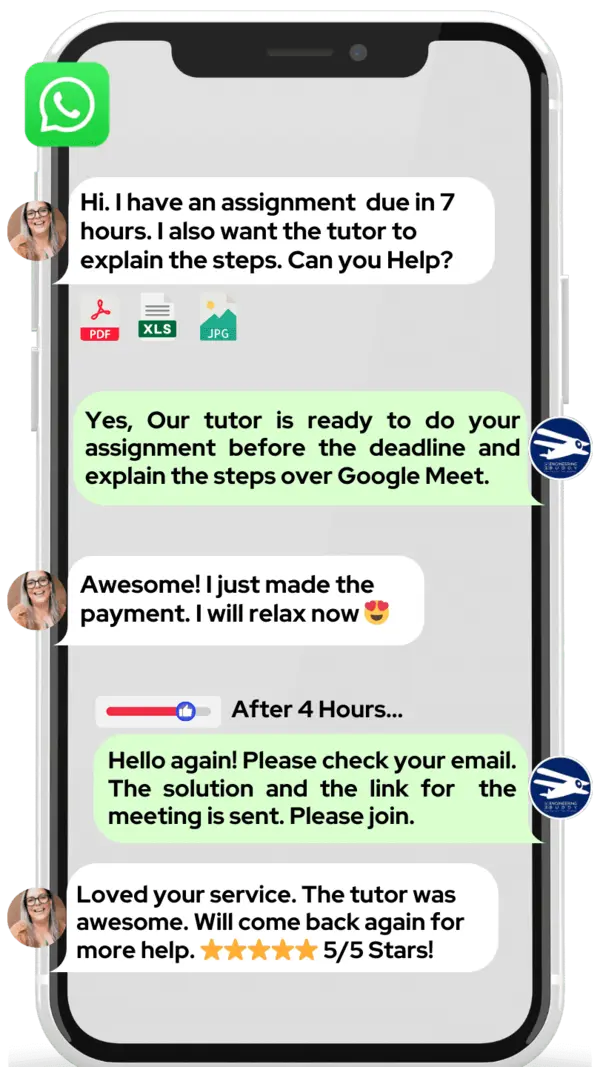

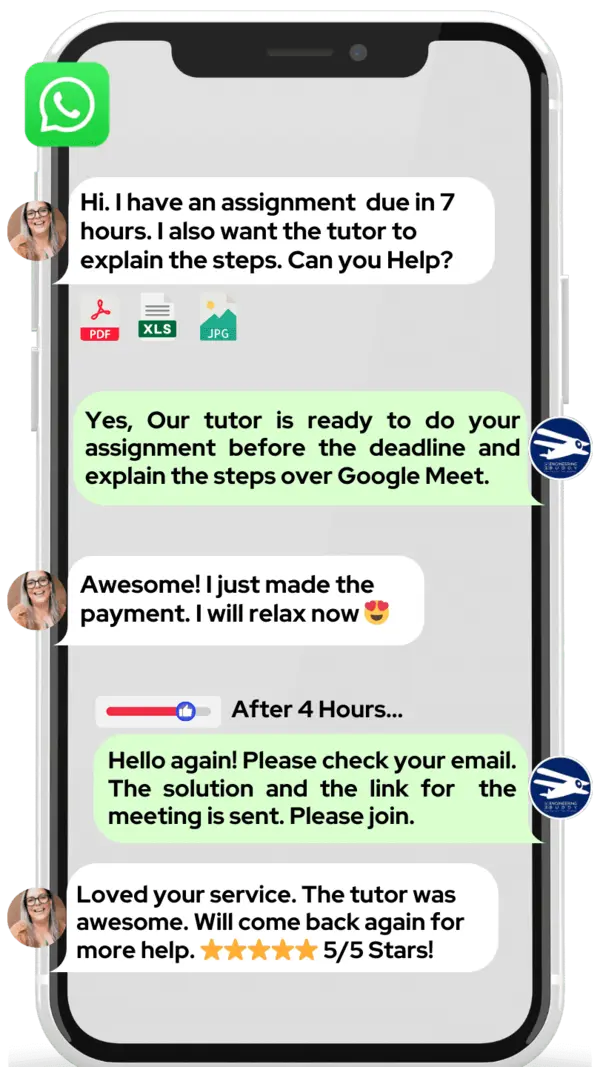

Do you want to learn personal finance? At MEB, we offer one‑on‑one online personal finance tutoring.

If you are a school, college or university student and you want top grades in your assignments, lab reports, live quizzes, projects, essays or long papers (sometimes called dissertations), try our 24/7 personal finance homework help.

We like to chat on WhatsApp. If you don’t use WhatsApp, send an email to meb@myengineeringbuddy.com

Many of our students live in the USA, Canada, UK, Gulf countries, Europe and Australia, but we help students everywhere.

Students ask for help when: • A subject is hard to learn • They have too many assignments • Questions or ideas seem too complex • They face health, personal or learning challenges • They work part‑time or miss classes

If you are a parent and your student is finding personal finance tricky, contact us today. Help your ward ace exams and homework—they will thank you!

MEB also supports over 1,000 other subjects. Our tutors are experts who make learning easier and stress free.

DISCLAIMER: OUR SERVICES AIM TO PROVIDE PERSONALIZED ACADEMIC GUIDANCE, HELPING STUDENTS UNDERSTAND CONCEPTS AND IMPROVE SKILLS. MATERIALS PROVIDED ARE FOR REFERENCE AND LEARNING PURPOSES ONLY. MISUSING THEM FOR ACADEMIC DISHONESTY OR VIOLATIONS OF INTEGRITY POLICIES IS STRONGLY DISCOURAGED. READ OUR HONOR CODE AND ACADEMIC INTEGRITY POLICY TO CURB DISHONEST BEHAVIOUR.

What is so special about Personal Finance?

Personal finance is special because it teaches you how to manage your own money. It covers real-life topics like budgeting, saving, investing, and planning for the future. Unlike corporate finance or economics, it focuses on your daily money choices and your personal goals. This hands-on approach makes the subject both practical and directly useful in everyday life.

Personal finance offers clear benefits: you learn money skills that help you avoid debt, build savings, and plan big purchases. It feels more useful than many abstract subjects. Still, it has downsides. It can be less challenging for students who like math theory. It also may offer fewer advanced study paths than subjects like economics, accounting, or programming courses.

What are the career opportunities in Personal Finance?

After a basic course you can move to a certificate in CFP or take a CFA level 1 exam. Some choose a master’s in finance or shorter online programs in fintech, tax planning or digital money management. Trend: blockchain and robo‑advisors.

Career scope covers banks, insurance firms and online financial services. You can work for fintech startups or credit unions. Demand is rising for experts who guide budgets, investments and retirement planning. Many firms offer remote work and flexible hours.

Popular roles include personal financial advisor, wealth manager, credit counselor and budget coach. Advisors meet clients to set goals, review spending, build saving plans and choose investments. Credit counselors help reduce debt and improve credit scores. Work blends client meetings and market research.

We learn personal finance to budget, save and invest wisely. Test prep and coursework build skills for real‑life money choices: taxes, loans and insurance. These skills lower financial stress, boost confidence and let you use tools like apps to track spending and goals.

How to learn Personal Finance?

Start by setting clear money goals—like saving for college or paying off debt. Next, learn core ideas: budgeting, saving, investing, credit scores and taxes. Follow a simple plan: watch a short video or read a chapter each day, practice creating a real budget spreadsheet, track your spending for a month, then tweak your plan. Review your progress every week and adjust goals as you learn what works best for you.

Personal finance isn’t as hard as it sounds. It’s mostly basic math and planning. If you take one concept at a time—say, how interest works or how to set up an emergency fund—you’ll build confidence fast. Real-life examples, like tracking your grocery spend, help cement ideas. With steady practice, simple terms and real numbers, what once seemed tricky will start to feel routine and clear.

You can definitely start on your own if you’re self‑disciplined. Many people learn by reading, using free online courses and trying out budgeting apps. But a tutor can speed things up by answering your questions right away, keeping you on track and giving feedback on your work. If you find yourself stuck or need a personalized plan, a tutor can guide you step by step.

Our MEB tutors specialize in personal finance and can build a study plan just for you. We offer online one‑to‑one sessions 24/7, homework support, sample quizzes and real‑life case studies. Whether you need help understanding a concept, preparing an assignment or gearing up for exams, our tutors explain ideas in clear, simple terms and help you put them into practice right away.

Learning the basics of personal finance typically takes a few weeks of steady work—about 30 minutes a day for two to three months—to get comfortable with budgeting, saving, investing and credit. To feel confident in applying these skills to real life, allow another month of practice tracking your spending and adjusting your plan as you go. If you aim for mastery or more advanced topics like retirement planning, give yourself three to six months of regular study and practice.

Resources to get you started: YouTube: “The Financial Diet,” “Khan Academy Finance,” “Dave Ramsey” Websites: Investopedia.com, Coursera.org (personal finance courses), NerdWallet.com Books: Personal Finance for Dummies by Eric Tyson; The Total Money Makeover by Dave Ramsey; Your Money or Your Life by Vicki Robin; The Simple Path to Wealth by JL Collins

College students, parents and tutors in the USA, Canada, UK, Gulf and beyond—if you need a helping hand with online 1:1 24/7 tutoring or assignment support, our MEB tutors can guide you at an affordable fee.